5 Easy Facts About Home Renovation Loan Described

Wiki Article

The Only Guide to Home Renovation Loan

Table of ContentsHome Renovation Loan Can Be Fun For AnyoneFacts About Home Renovation Loan Uncovered6 Simple Techniques For Home Renovation LoanThe 15-Second Trick For Home Renovation LoanThe Greatest Guide To Home Renovation LoanHome Renovation Loan - Questions

You'll likewise have to reveal invoices for the work and send a last evaluation report to your financial organization. You could want to acquire funding protection insurance policy to minimize the dimension of your down repayment.Refinancing can be beneficial when the renovations will add value to your home. By increasing its value, you raise the probability of a roi when you market. Like all funding options, this one has both advantages and negative aspects. Benefits: The rates of interest is generally reduced than for other kinds of financing.

Similar to any type of credit rating line, the cash is offered in all times. The rate of interest are generally reduced than for several various other kinds of financing, and the rate of interest on the credit scores you have actually used is the only point you need to be sure to pay each month. You can use your line of credit for all kinds of jobs, not just remodellings.

Not known Details About Home Renovation Loan

Advantages of a personal line of credit report: A credit rating line is versatile and provides fast accessibility to cash money. You can restrict your regular monthly settlements to the rate of interest on the debt you've utilized.

Benefits of a personal lending: With a personal financing, you can pay off your restorations over a predefined duration. It's an excellent way to see to it you reach your settlement objectives if you need help to stay on track. Factors to consider: When you have actually settled an individual financing, that's it. It's closed.

Home Renovation Loan Things To Know Before You Buy

, so you may be able to reduce your prices this way. You'll have to make certain the monetary support and credit scores are still being used when the work starts and that you fulfill the eligibility requirements.Wish to make certain your ways match your passions? Determine you could look here your debt-to-income ratio. Talk with your advisor, who will certainly assist you choose the solution that fits you ideal. Last but not least, you can try this out create a basic spending plan along with your remodelling spending plan. By contrasting the two, you'll see exactly how big a regular monthly loan repayment you can produce the improvements.

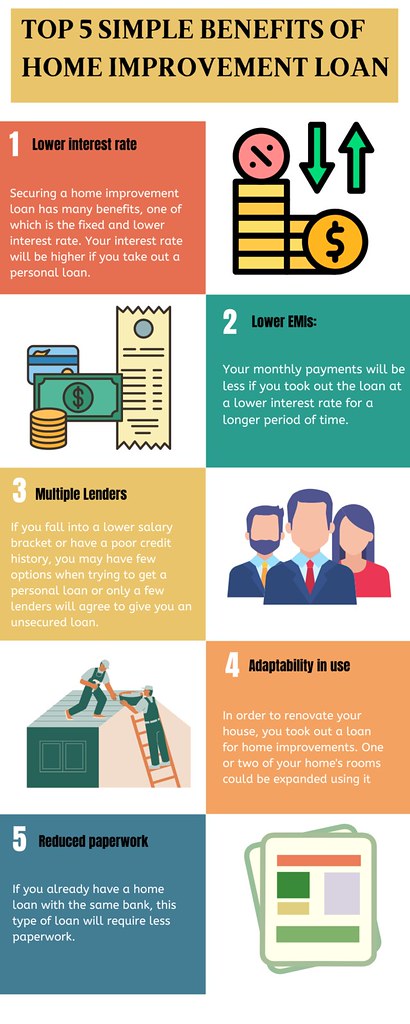

There are many factors to remodel a home, yet many home owners do so with the intent of increasing their home's worth should they make a decision to market in the future. Financing home remodelling projects with home remodelling car loans can be a terrific means to reduce your expenses and improve your return on investment (ROI). Below are a few details advantages of home remodelling funding.

The 8-Second Trick For Home Renovation Loan

This may not be a large bargain for smaller remodellings, but when it involves long-term tasks, bank card financing can promptly get expensive. Home renovation fundings are an even more affordable solution to utilizing charge card to spend for the materials needed for home improvements. While rates of interest on home remodelling finances differ, they often tend to be within the variety of Prime plus 2.00 percent (presently, the prime rate is 3.00 percent).There are also lots of different terms available to suit every task and spending plan. If you require the funds for an one-time project, an equity financing with a fixed regard to 1 to 5 years may be best suited your needs. If you need more versatility, a credit line will certainly allow you to obtain funds as needed without requiring to reapply for credit score.

In certain provinces, such as Quebec, the give needs to be incorporated with a provincial program. There are a number of steps to take - home renovation loan. Have your home assessed by an EnerGuide power consultant. You'll obtain a report that can assist your remodelling decisions. Once the job has been done, your home will certainly be examined again to verify that its power performance has actually enhanced.

In addition to government programs, take some time to check out what's available in your district. There could be money simply waiting for you to claim it. Below's a summary of the major home renovation grants by district.

The Definitive Guide for Home Renovation Loan

Additionally, all residents can apply to the Newfoundland Power and Newfoundland and Labrador Hydro takeCHARGE program for rewards to help with projects such as upgrading their insulation or installing a heat recovery ventilator. House owners can additionally conserve when they update to a next-generation thermostat. If you reside in the Northwest Territories, you can use for a cash rebate on all type of items that will certainly help lower your energy consumption in your home.If you possess a home right here, you could be qualified for refunds on high-efficiency heating tools - home renovation loan. What's even more, there are incentives for the acquisition and installment of read this post here solar panels and low-interest lendings for renovations that will certainly make your home a lot more power reliable.

The amount of economic assistance you can get differs from under $100 to a number of thousand bucks, depending upon the project. In Quebec, the Rnoclimat program is the only means to access the Canada Greener Houses Give. The Chauffez vert program offers incentives for changing an oil or gas furnace with a system powered by renewable resource such as electrical energy.

Rumored Buzz on Home Renovation Loan

Saskatchewan just offers incentive programs for companies. Keep an eye out for new programs that could likewise apply to homeowners.

Remodellings can be difficult for households., remember to variable in all the ways you can save money.

Report this wiki page